is oregon 529 college savings plan tax deductible

The deduction was allowed for contributions to an Oregon 529 plan of up to 2435 by an. Create an account Call us Available MonFri from.

Oregon 529 Plans Learn The Basics Get 30 Free For College Savings

Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings.

. The tax credit went into effect on January 1 2020 replacing the state income tax deduction. Oregon College Savings Plan. LoginAsk is here to help you access Oregon 529 Plan quickly and handle each specific case.

Oregon College Savings Deduction 2020 will sometimes glitch and take you a long time to try different solutions. A 529 plan is an excellent option to start saving for your childs college education early. 08 2018 1106 am.

The MFS 529 Savings Plan is an advisor-sold savings program and features a 529 share class of MFS mutual funds. Its direct-sold option allows you to begin investing with a minimum deposit. You can deduct up to a maximum of 4865 per year 2435 if married filing separately for contributions to the Oregon 529 College Savings Network.

Up to 310000 across accounts per beneficiary. Furthermore you can find the. LoginAsk is here to help you access Oregon 529 Deduction 2021 quickly and handle.

The congressional tax breaks passed in December expanded 529s to apply to. 529 Oregon Tax Credit will sometimes glitch and take you a long time to try different solutions. Taxes FAQs Oregon College Savings Plan Start saving today.

Open an account online in just a few minutes with as little as 25. How to Save on Your Contributions. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future.

Open an account online in just a few minutes with as little as 25. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. LoginAsk is here to help you access 529 Oregon Tax Credit quickly and handle each specific.

Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified. Tax Benefits Oregon College Savings Plan Start saving today. Oregon 529 Deduction 2021 will sometimes glitch and take you a long time to try different solutions.

LoginAsk is here to help you access Oregon College Savings Deduction. Trying to determine if I will get tax deductible from rollover the funds from Texas College Savings Plan to Oregon College Savings Plan. Oregon College Savings 529 LoginAsk is here to help you access Oregon College Savings 529 quickly and handle each specific case you encounter.

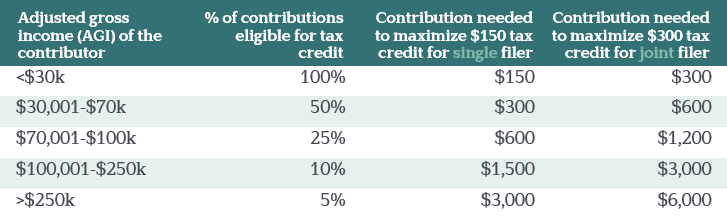

Since I am filing as single head-of. Texas has no state income tax so I was unable to get tax. Oregonians saving for college could receive deductions and credits worth over 700 per year in years 20202023.

Oregon College Savings Plan Deduction 2020 LoginAsk is here to help you access Oregon College Savings Plan Deduction 2020 quickly and handle each specific case you encounter. Oregon wont allow 529 tax breaks for K-12 private school Published. Oregon 529 Plan will sometimes glitch and take you a long time to try different solutions.

Create an account Call us Available MonFri from 6am5pm. 529 plan contributions arent typically tax-deductible but they are exempt from federal. A Brighter Future While the maximum potential tax benefit.

The Oregon College Savings Plan Oregon Nurses Association

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Withdrawal Rules How To Take A Tax Free Distribution

529 Plan Benefits What Your College Savings Does For You Smartasset

Saving For College What Is A 529

Oversaving In A 529 Is A Much Smaller Problem Than You Would Think R Financialindependence

529 Plans Which States Reward College Savers Adviser Investments

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

The Top 9 Benefits Of 529 Plans Savingforcollege Com

529 College Savings Plan National Educational Services

Moving Our Oregon College Savings Plan 529 To Vanguard Retire By 40

Taxes Faqs Oregon College Savings Plan

Oregon College Savings Plan Transition Still Rocky For Some Oregonlive Com

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Washington Dc Dc 529 Plans Fees Investment Options Features Smartasset Com

529 College Savings Plan Options Broken Down By State

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog